With S&P forecasting that credit losses will remain twice as high as pre-pandemic levels in 2021 in Western Europe, many financial institutions are dusting themselves off from the crisis and re-evaluating their credit risk. Recession, unemployment and rising taxes will all play their part to make it much more difficult, and much more important, to make good credit decisions.

This is set against a background of increasing pressure on customer experience. Customers expect fast, even real time, decisions that reflect their personal financial situation. This is putting pressure on banks to tap into all the available sources of first and third-party data to make the right decision for the right customer and at the right time.

If you are looking for ways to balance the competing pressures of credit risk, customer experience and regulation, join us as we explore this topic with a group of senior banking executives.

Who Should Attend?

Senior decision makers and other top-executives, including thought leaders from the UK’s top banks.

Attendance is capped to ensure every participant is able to contribute. The meeting is only open to invited participants or those who has been referred by a colleague or our partner, Precisely

WHO’S OUR CLUB PARTNER?

Precisely builds trust into data. They create an end-to-end, mature product portfolio with a singular focus on data integrity – they help their customers move forward with confidence. Today, they have 12,000 enterprise customers, including 90 of the Fortune 100, in 100 countries worldwide.

What is the experience?

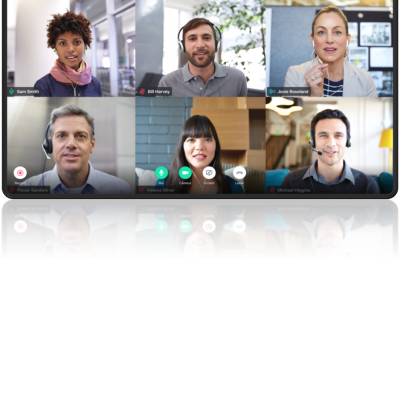

All of our virtual roundtables are focused, collaborative and informative. As a participant you join via video and – thanks to a chaired and moderated discussion – take away actionable ideas to implement within your business and with your customers.

Prior to the virtual meeting taking place, each attendee is interviewed to understand their interests and perspective. Those who register early will also contribute towards the insight report, which will be published prior to the virtual meeting and will be the focus of the discussion.

The Team

James Harris

Founder

Georgina Hayes

Club Director

Philippa Brown

Research Director

Camilla Jørgensen

Research Director

George Parry

Research DirectorElle Brasier

Operations ManagerIf you have a question about attendance, please contact me:

Georgina Hayes

Club Director, Change Makers Club